Expect the unexpected

Built for a world that's changing

Announcing the production release of the Proteus Scenario Generator - a real world generator of economic and risk scenarios for your business.

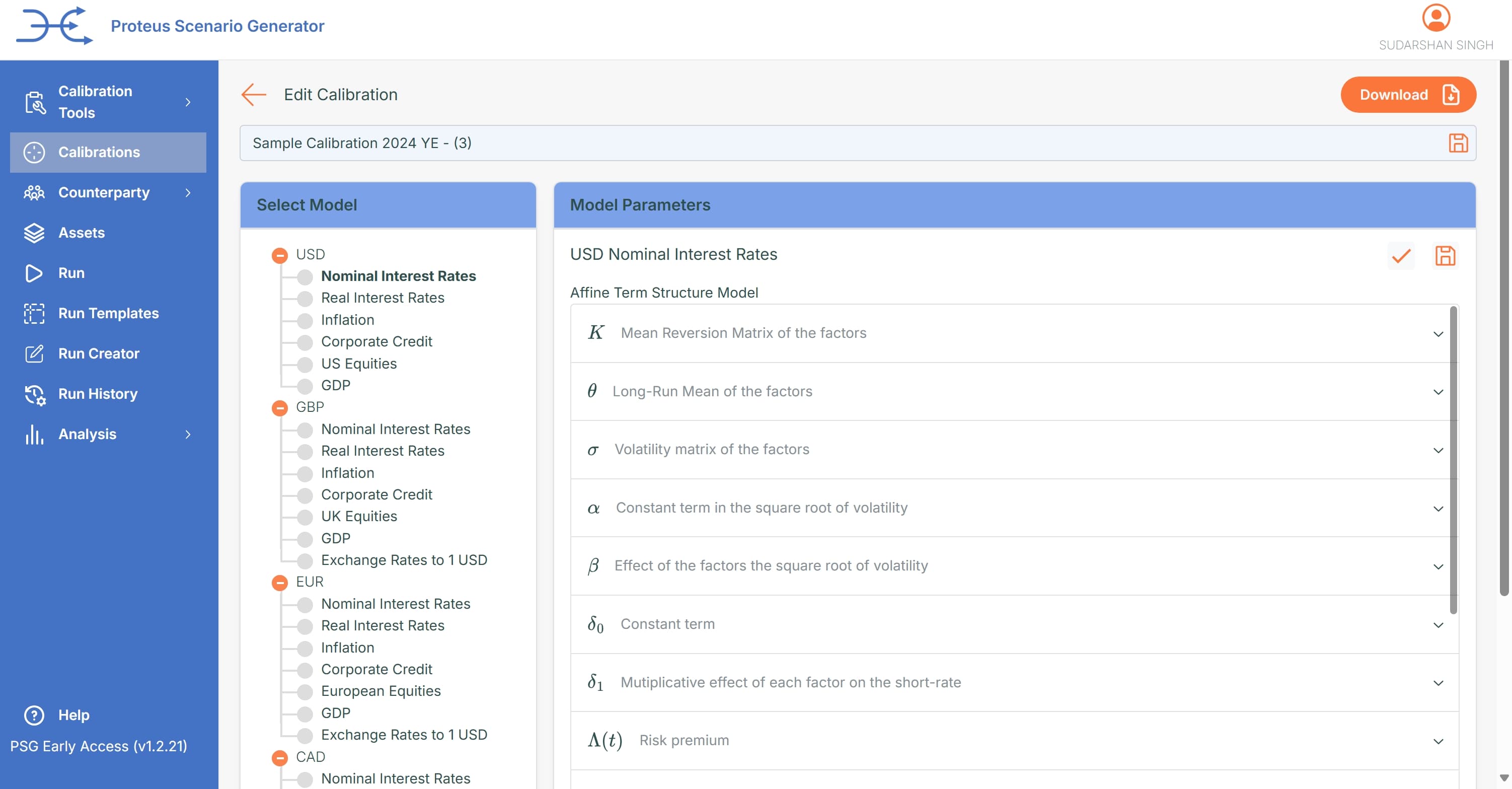

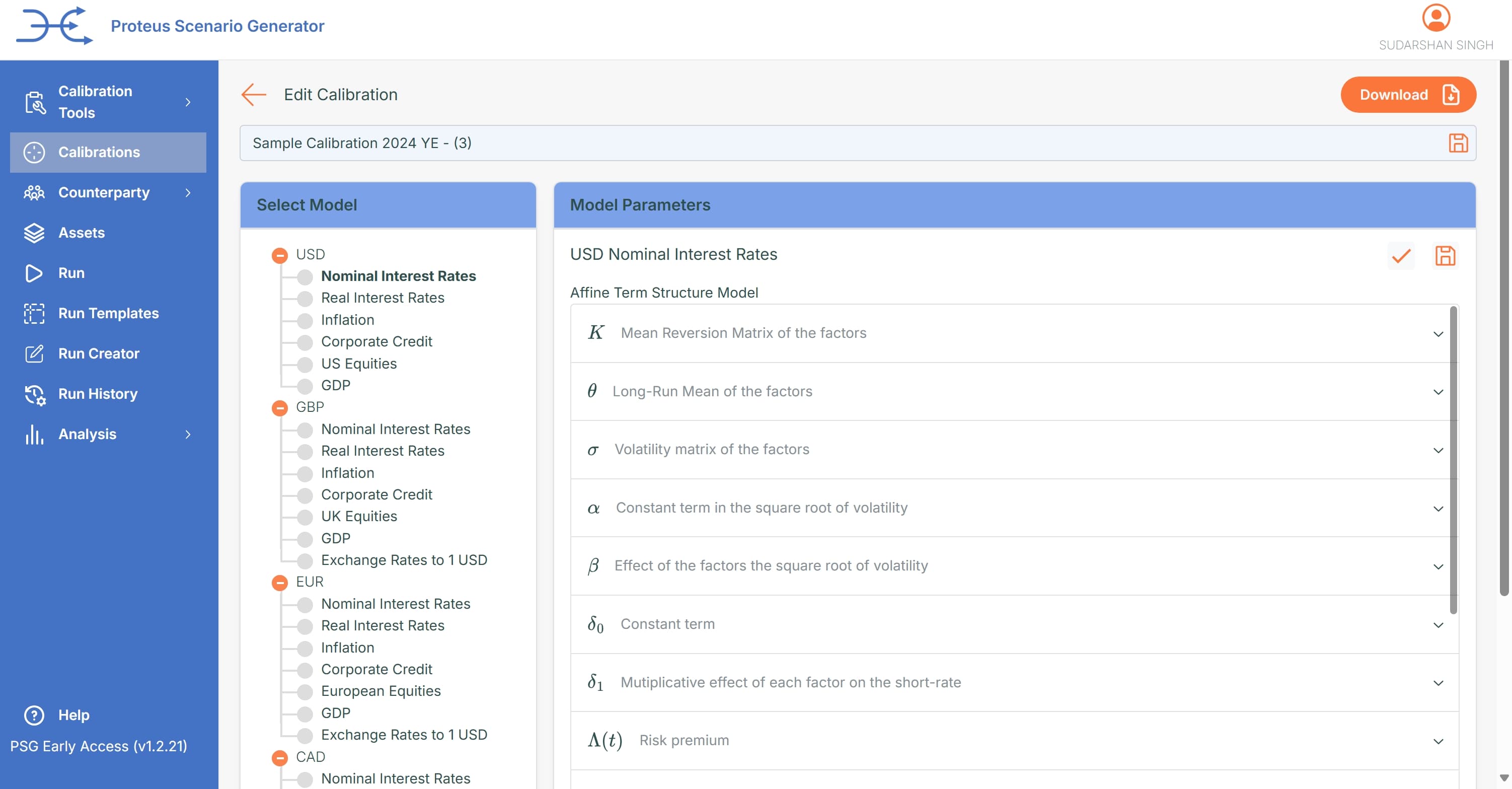

'No Code' Platform

We offer a 'No Code' platform with full visibility to analytic mathematics, including model training and regulatory support.

Many of our analytic engines are available on an Open Source basis under an MIT license.

We provide a full suite of analytic tools to allow you to create your own calibrations and models. Our models can be targeted to your specific economic outlook and there is no need to wait for updated calibrations each month or quarter.

Out of the Box Calibrations

We provide stable calibrations for major economies. Updates only required on an annual (or less frequent) basis.

Our economic indices capture traditional and alternative equity markets, interest rates, credit, inflation(nominal and real), FX, correlations and geopolitical risk.

Self Calibration

Tools available to easily create your own calibrations and / or input a market starting position.

Model parameters are complex and our easy to use tools allow you to create or update base parameters with ease.

Assets

A comprehensive suite of asset returns generated consistently with your chosen calibration.

Assets include a wide array of equity indices, government and corporate bonds, linkers, cash, FRNs and Swaps.

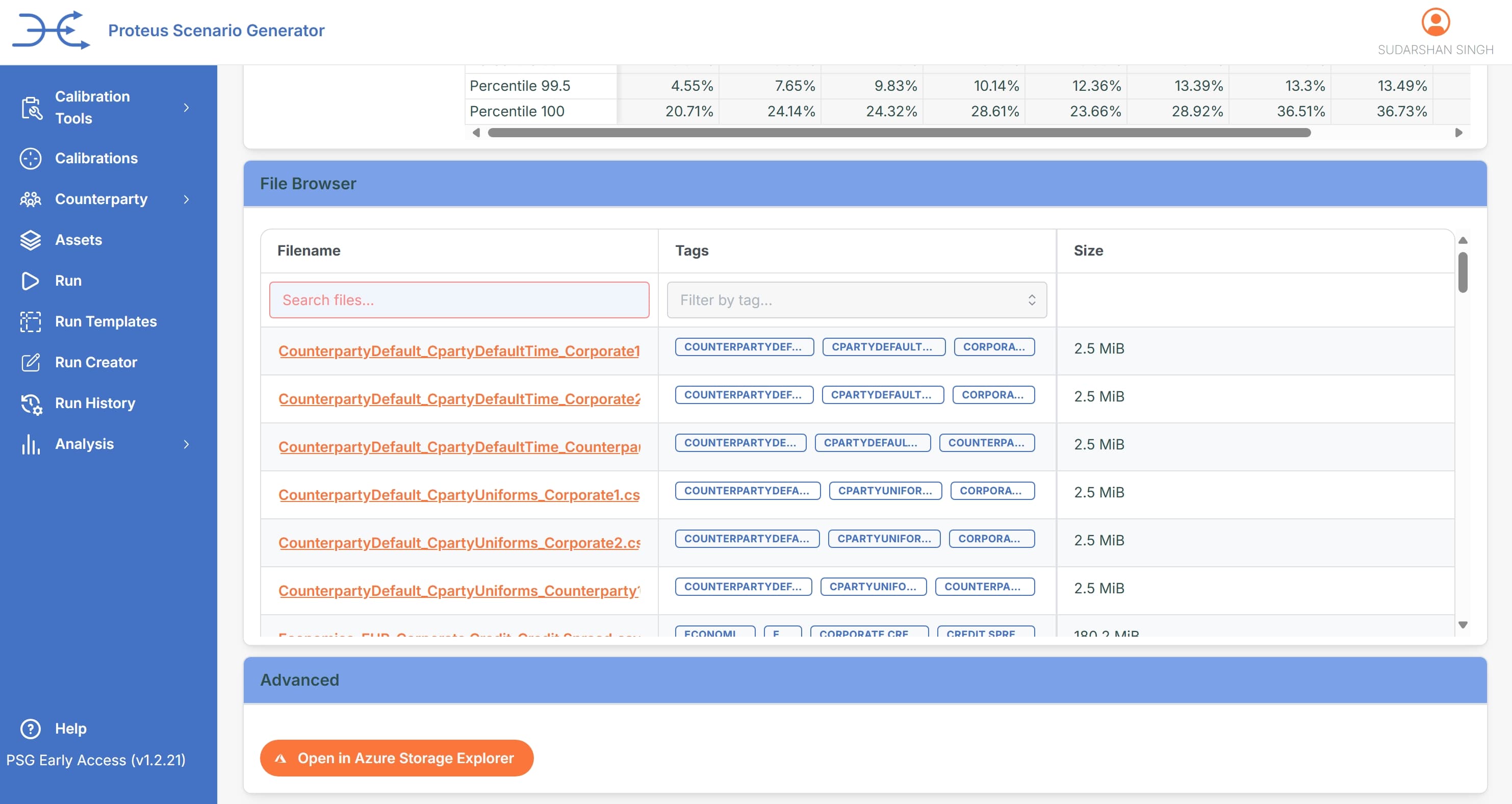

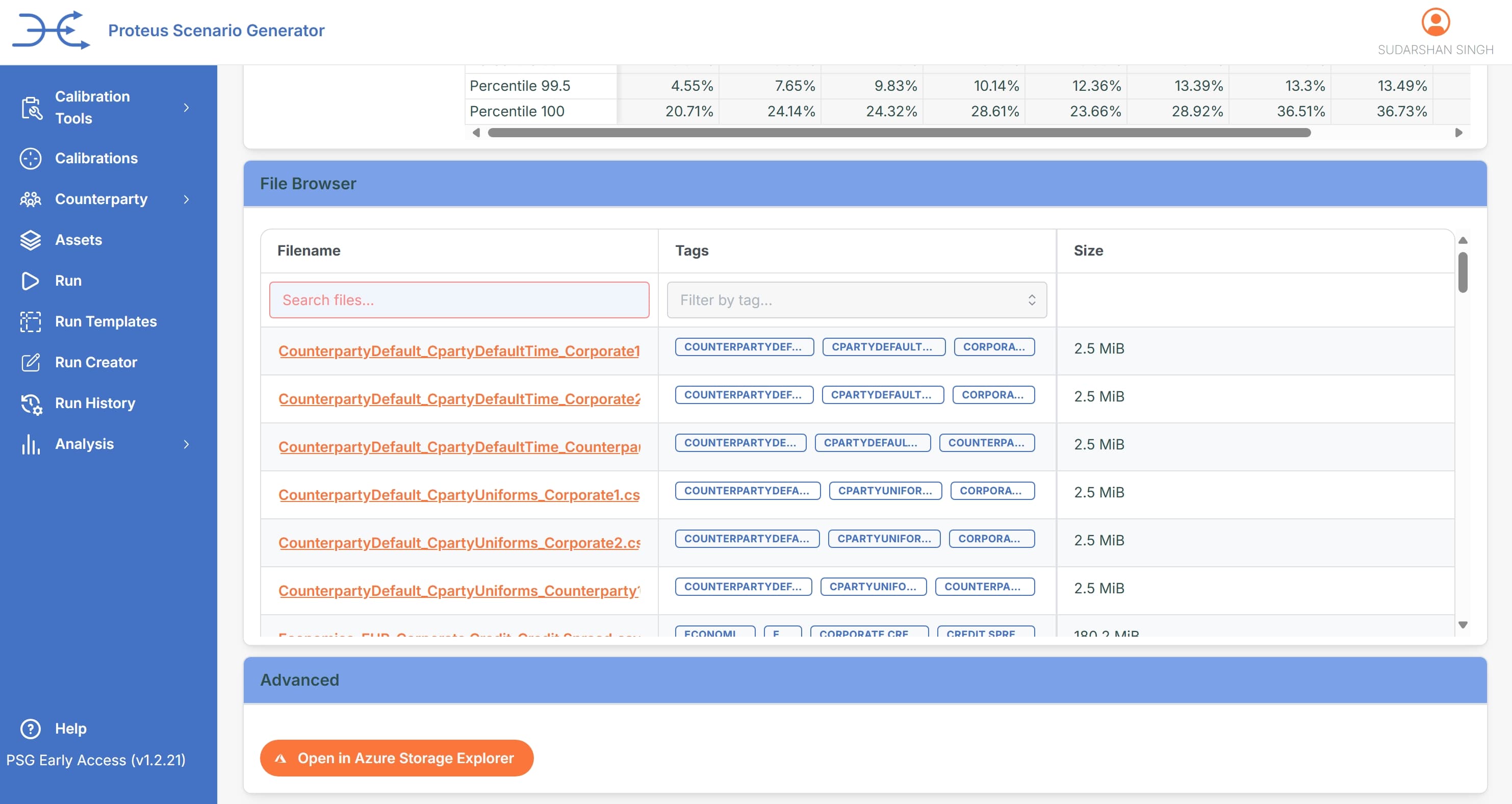

Download Files Control

Easily manage and download your generated files with our intuitive file control system.

Access and download your scenario results, calibration reports, and other generated files through our streamlined interface.

Out of the Box Calibrations

We provide stable calibrations for major economies. Updates only required on an annual (or less frequent) basis.

Our economic indices capture traditional and alternative equity markets, interest rates, credit, inflation(nominal and real), FX, correlations and geopolitical risk.

Self Calibration

Tools available to easily create your own calibrations and / or input a market starting position.

Model parameters are complex and our easy to use tools allow you to create or update base parameters with ease.

Assets

A comprehensive suite of asset returns generated consistently with your chosen calibration.

Assets include a wide array of equity indices, government and corporate bonds, linkers, cash, FRNs and Swaps.

Download Files Control

Easily manage and download your generated files with our intuitive file control system.

Access and download your scenario results, calibration reports, and other generated files through our streamlined interface.

Support

Frequently asked questions

Have a different question and can't find the answer you're looking for? Reach out to our support team by contacting us and we'll get back to you as soon as we can.